taxing unrealized gains crypto

The proposed 20 tax on unrealized gains was put forward by the US Department of Treasurys 2023 Income Proposition. After all someone who bought Bitcoin at its value of about 30000 in July of 2021 would have ended the year with about 17000 in unrealized gains per Bitcoin gains which have since.

Harvesting Crypto Losses Just Got Easier Taxbit Releases Updates To Tax Optimizer Taxbit

American stocks and crypto holders are braced for another tax-themed body blow from the government with House Speaker Nancy Pelosi claiming that a.

. If given the power to tax unrealized gains expect the feds to expand. Unrealized Capital Gains Tax Is Frankly Bananas. The new proposal is framed as a tax on the ultrarich.

The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. The same was true of the new income tax in 1913.

It can potentially become a penalty for being. Speaking on CNNs State of the Union on Oct. American stocks and crypto holders are braced for another tax-themed body blow from the government with House Speaker Nancy Pelosi.

The proposed 20 tax on unrealized gains put forward by the US Department of Treasury s 2023 Revenue Proposal could potentially become a penalty for being successful. An unrealized capital gains tax on corporate assets could hit those with real estate especially hard but companies with bitcoin also come to mind. We all know that the government has proposed taxing unrealized crypto gainsas in taxing our crypto portfolios that we havent profited on.

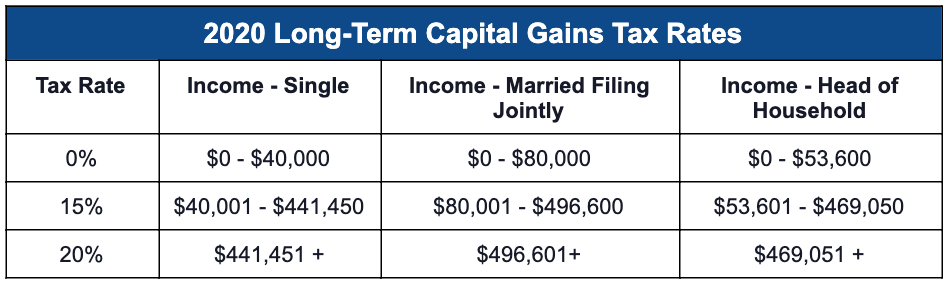

43522 150 035. You have an unrealized profit of 10000. If you hold your stock or crypto for over a year then you have the benefit of long-term capital gains.

The price of BTC has increased by 3000 but you havent sold your asset. For example if you were ahead. For example if you bought 1 BTC for 30000 and the price of BTC has increased to 40000.

Due to falling stock prices ATTs dividend. 12 a level that could induce some investors to choose bonds instead of stocks. This almost sounds like a mafia scam.

The short answer to the question of how the unrealized capital gains rule would affect you is that it probably wont because it. Is exploring plans to tax unrealized capital gains sparking fierce criticism on Crypto Twitter. If you had any losing stock or crypto losses when you sold you can.

Treasury Secretary Janet Yellen has revealed that the US. A 2-year Treasury note now pays 43 as of Oct. Speaking to CNN on Sunday the.

For instance a good example would be the increase. CMC Crypto 200. Ad Invest your retirement funds in Bitcoin Ethereum Solana Cardano Sushi and 150 more.

You buy 05 Bitcoin for 30000. Similarly if the price of BTC dropped to. Like these assets the money you gain from crypto is taxed at different rates either as capital gains or as income depending on how you got your crypto and how long you held on to it.

An unrealized gain refers to a potential profit that exists on paper- usually as a result of investments but that is not yet in reality. You have an unrealized gain of 3000. With 247 trading and investment minimums as low as 10 its so easy to get started.

2021 2022 Crypto Tax Glossary Coinbase

How Would Unrealized Capital Gains Tax Affect You

Why Biden S Hostile Tax Proposal Threatens Crypto Investors

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

Crypto Tax Unrealized Gains Explained Koinly

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles And Expert Insights

Unrealized Capital Gains Taxes Why Monero Is Important R Monero

Cryptocurrency Taxes A Guide To Tax Rules For Bitcoin Ethereum And More Bankrate

How Is Cryptocurrency Taxed Forbes Advisor

Tax Surprise Looms For Nft Investors Who Use Crypto

Unrealized Capital Gains Tax Capital Flight Possible Youtube

The Us Government Wants To Tax Unrealized Gains Crypto Investment Tips Mtltimes Ca

Crypto Capital Gains And Tax Rates 2022

Paying Taxes On Bitcoin Is Surprisingly Simple

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These R Taxbit

Biden S Capital Gains Tax Plan To Pull Crypto Down To Earth From The Moon

Why Biden S Hostile Tax Proposal Threatens Crypto Investors